ZATCA Phase 2 E-Invoicing Integration

Complete documentation for ZATCA (Zakat, Tax and Customs Authority) Phase 2 e-invoicing integration. This integration enables businesses in Saudi Arabia to automatically generate, sign, and submit compliant electronic invoices to ZATCA's Fatoorah platform.

Overview

The ZATCA Phase 2 e-invoicing integration enables businesses in Saudi Arabia to automatically generate, sign, and submit compliant electronic invoices to ZATCA's Fatoorah platform. This integration ensures full compliance with Saudi Arabia's e-invoicing regulations.

Key Features

- Automatic Invoice Submission: Invoices are automatically submitted to ZATCA when created and submitted

- XML Generation: Automatic generation of ZATCA-compliant XML invoices

- Digital Signing: Automatic signing of invoices using ZATCA CLI

- QR Code Generation: Automatic QR code generation for invoices

- Compliance & Production Modes: Support for both compliance testing and production environments

- Queue Management: Built-in queue system for batch processing

- Integration Logging: Comprehensive logging of all ZATCA operations

Prerequisites

Before starting the ZATCA integration setup, ensure you have:

- ZATCA Account: An active account on the Fatoorah platform (https://fatoorah.gov.sa)

- VAT Registration: Valid VAT registration number

- Company Information: Complete company details including:

- Legal company name

- VAT registration number

- Company address (street, building number, city, postal code, district)

- Commercial registration details (if applicable)

- System Requirements:

- Java 11 or higher (for ZATCA CLI)

- Internet connection for API communication

- Valid SSL certificates

Initial Setup

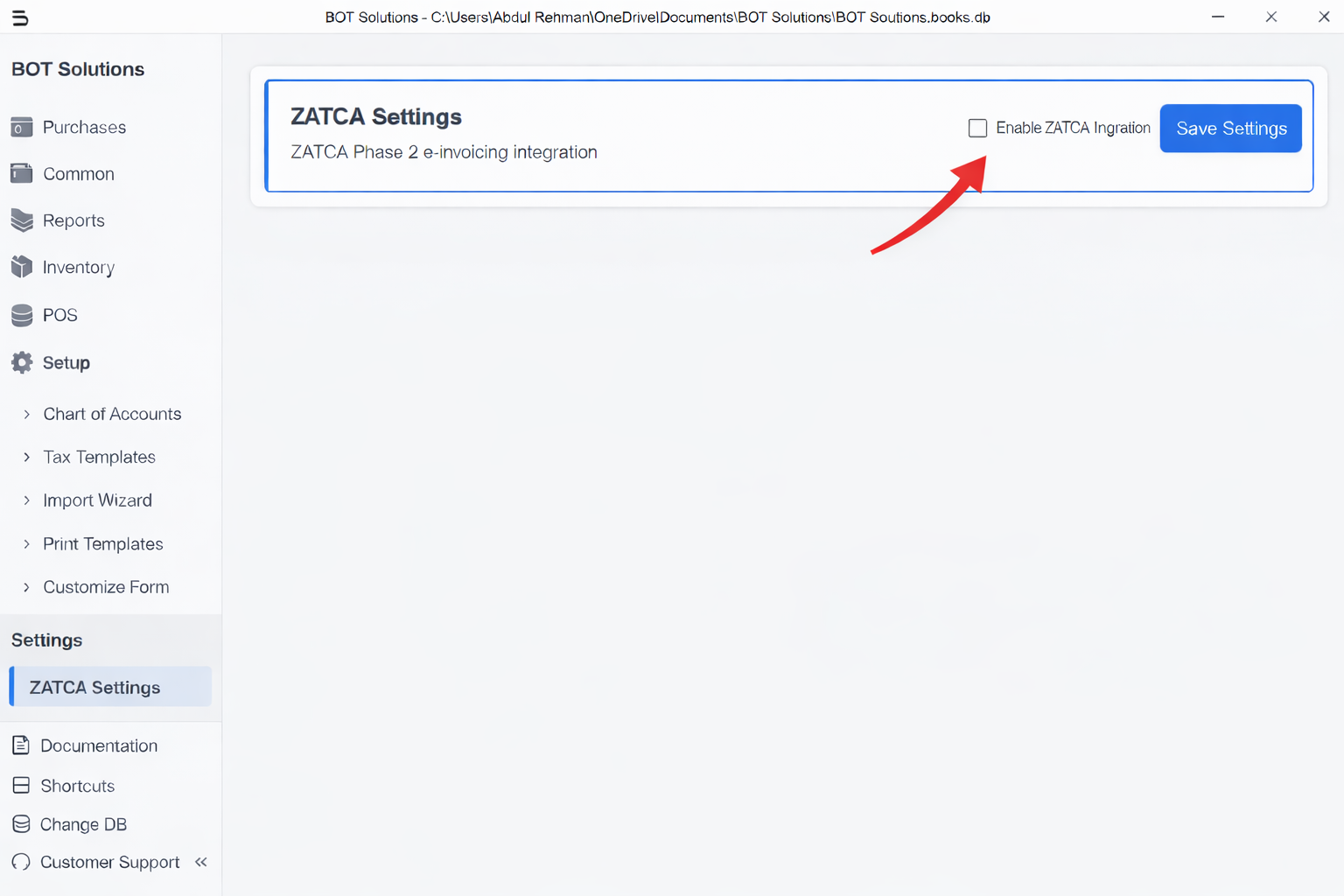

Step 1: Enable ZATCA Integration

- Navigate to Settings → ZATCA Settings

- Check the "Enable ZATCA Integration" checkbox

- Click "Save Settings"

Once enabled, additional configuration options will become available.

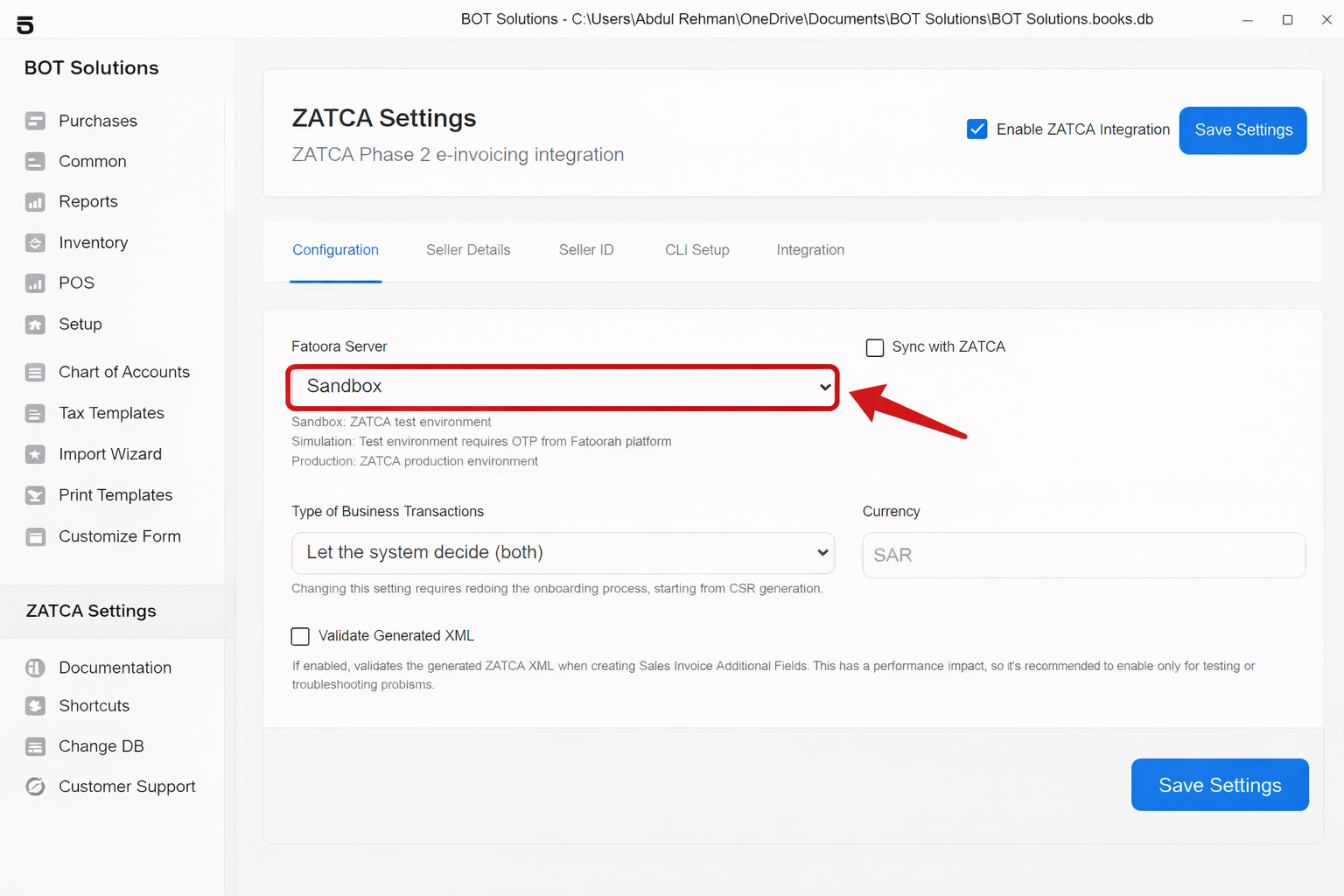

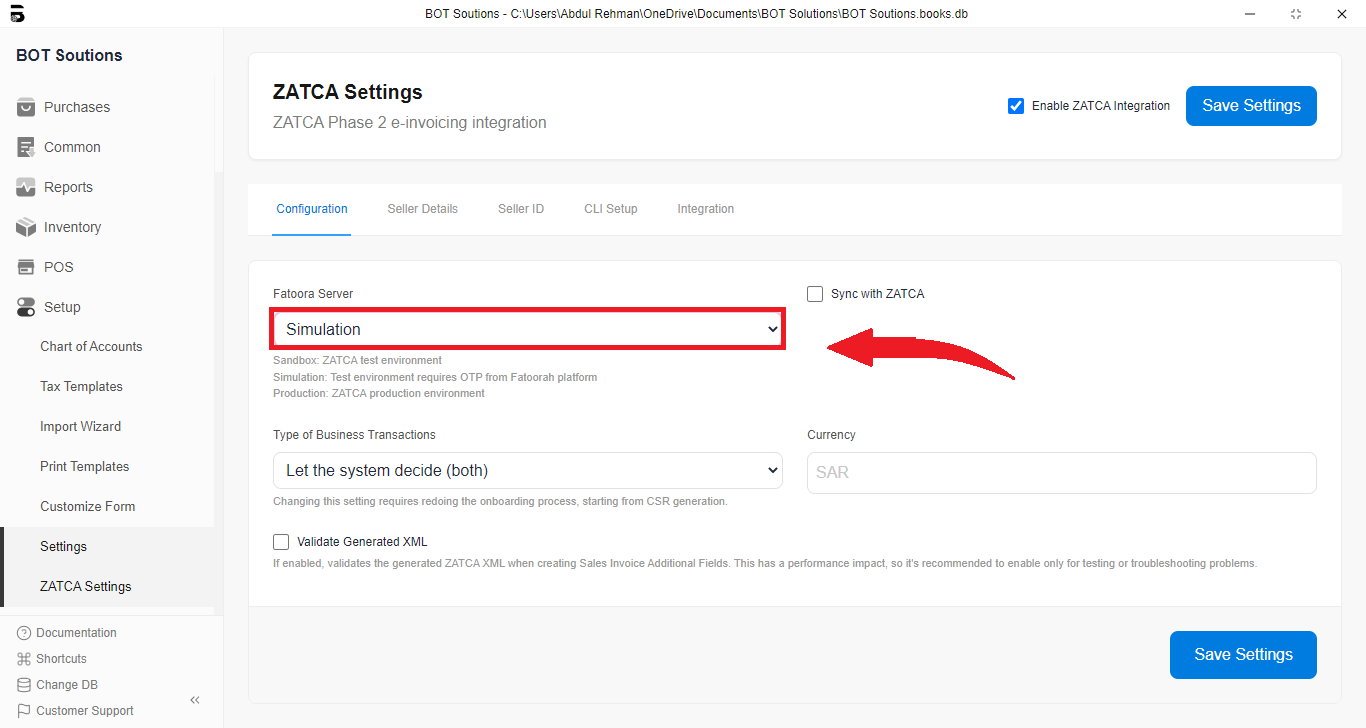

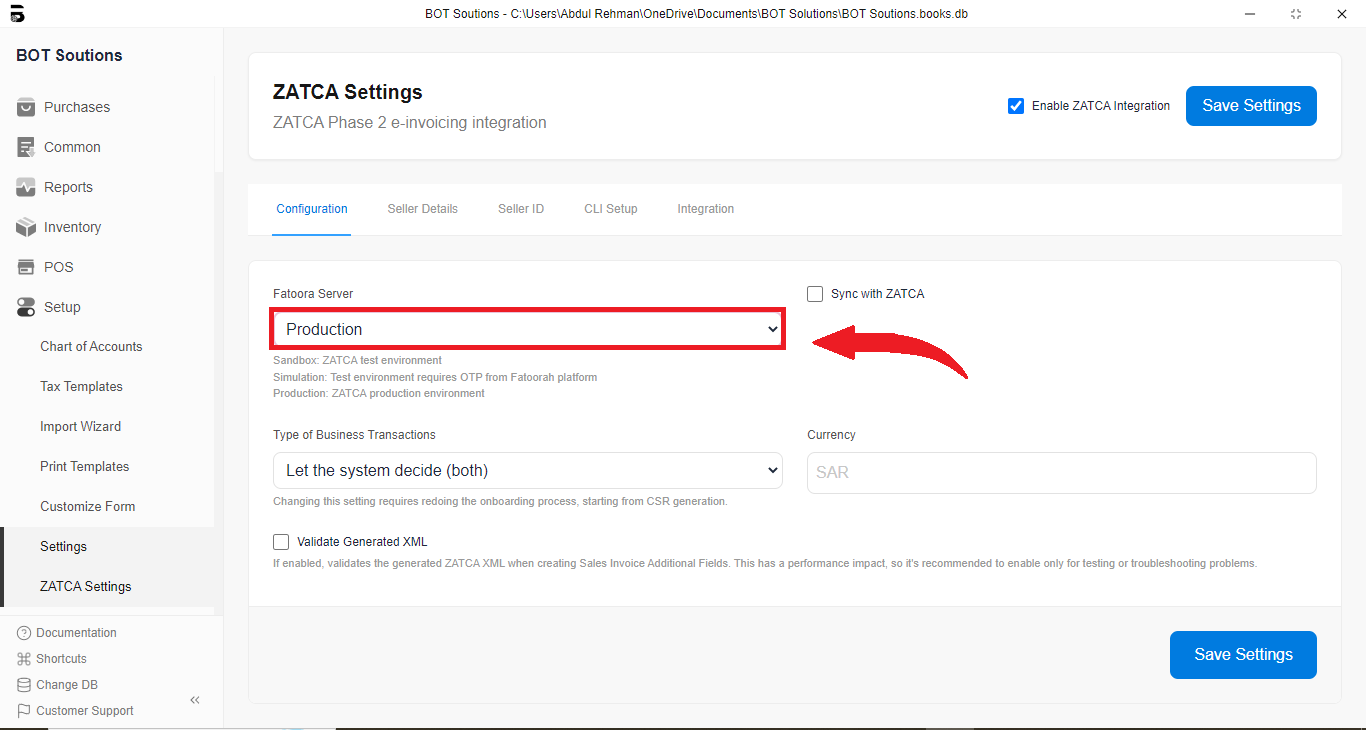

Step 2: Configure Basic Settings

Fatoora Server Environment

Select the appropriate environment:

- Sandbox: ZATCA test environment (for initial testing)

- Simulation: Test environment requiring OTP from Fatoorah platform

- Production: ZATCA production environment (for live operations)

Important: Start with Sandbox for testing, then move to Simulation before going to Production.

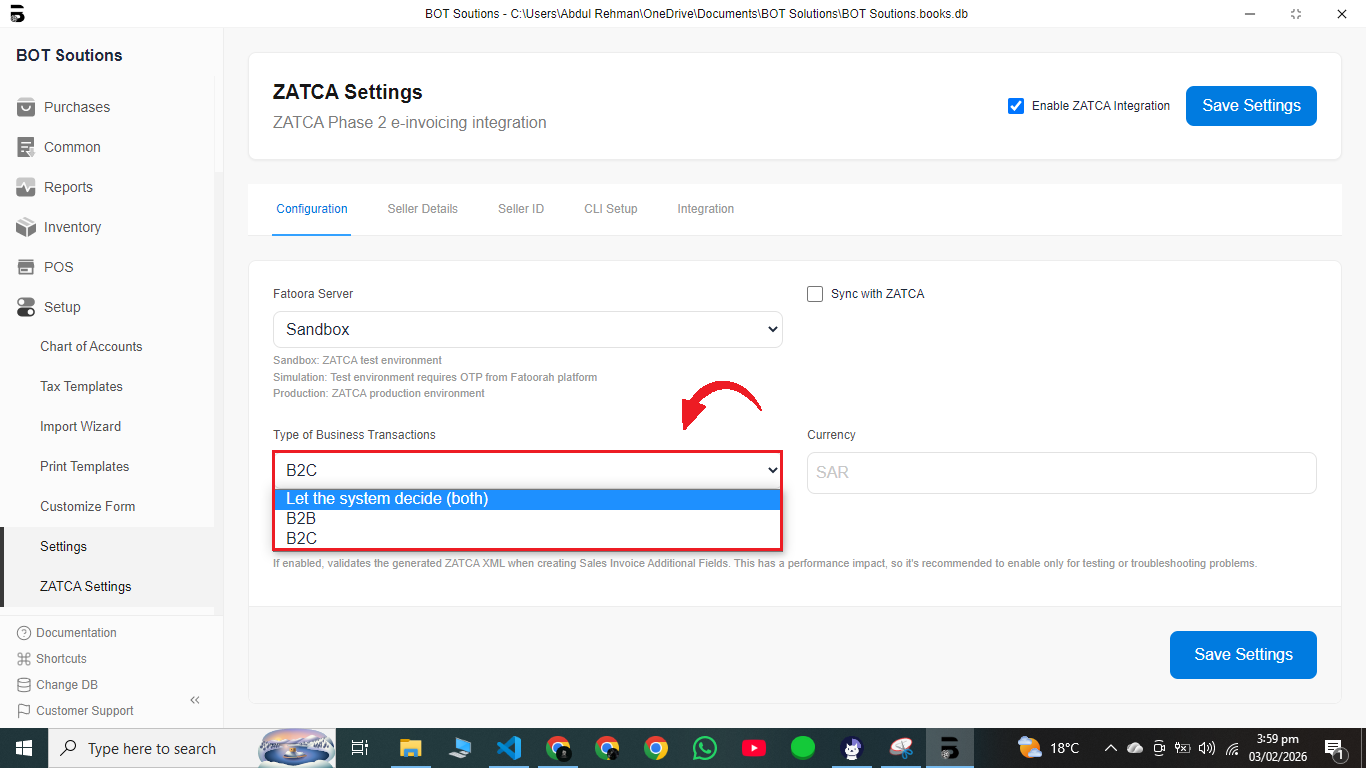

Type of Business Transactions

Choose your business transaction type:

- Let the system decide (both): Automatically determines B2B or B2C based on customer VAT registration

- B2B: Business-to-Business transactions only

- B2C: Business-to-Consumer transactions only

Note: Changing this setting requires redoing the onboarding process from CSR generation.

Currency

Select the currency for your invoices (typically SAR for Saudi Arabia).

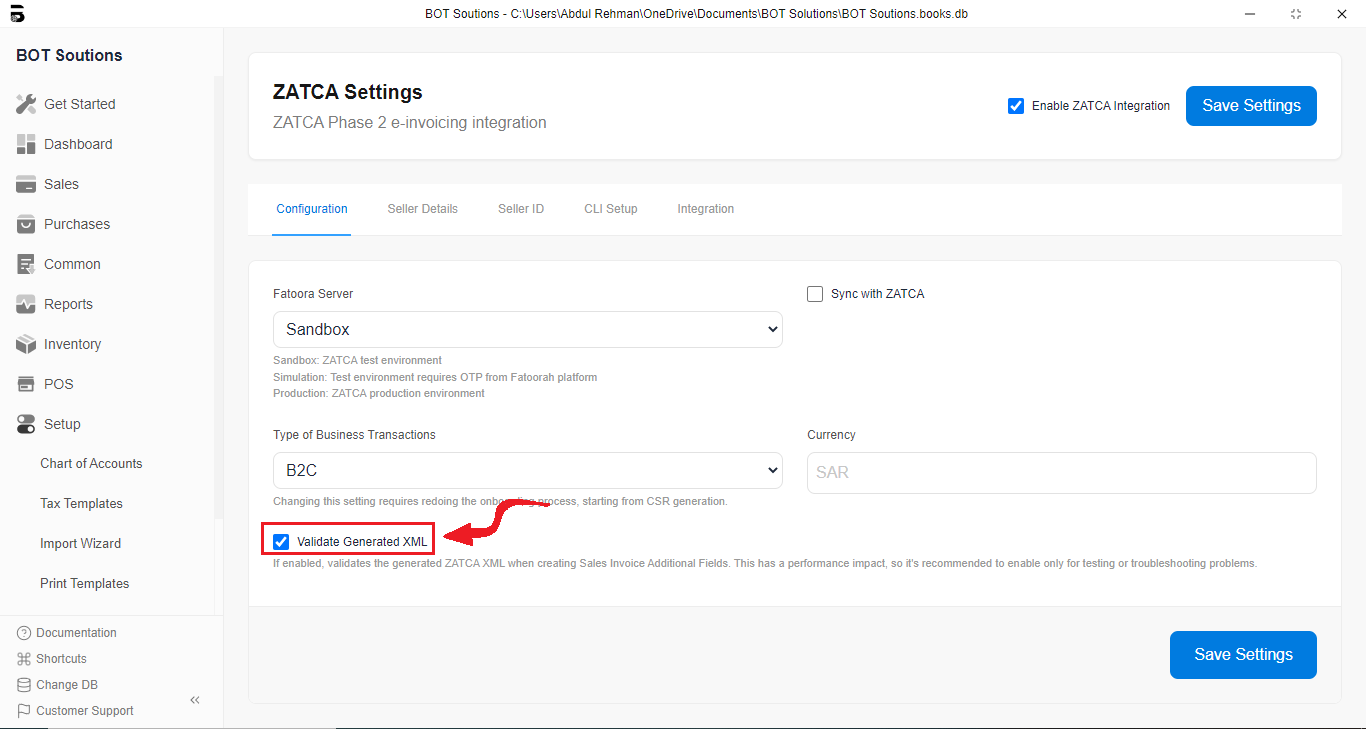

Validate Generated XML

- Enabled: Validates XML during creation (recommended for testing/troubleshooting)

- Disabled: Skips validation for better performance (recommended for production)

Configuration

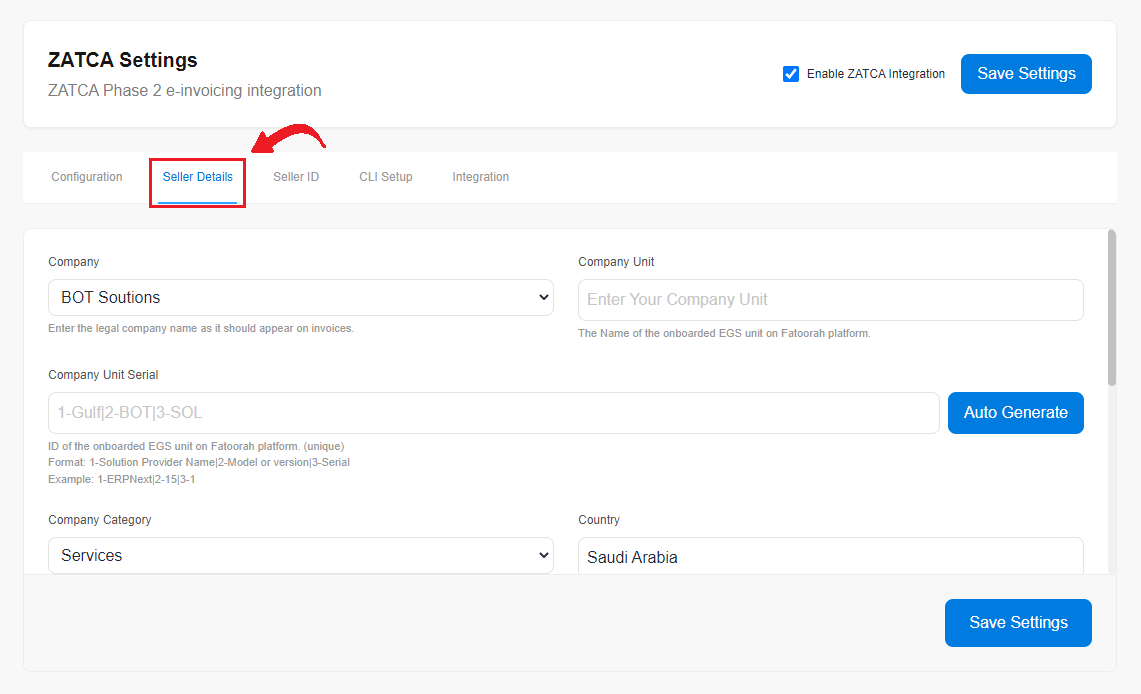

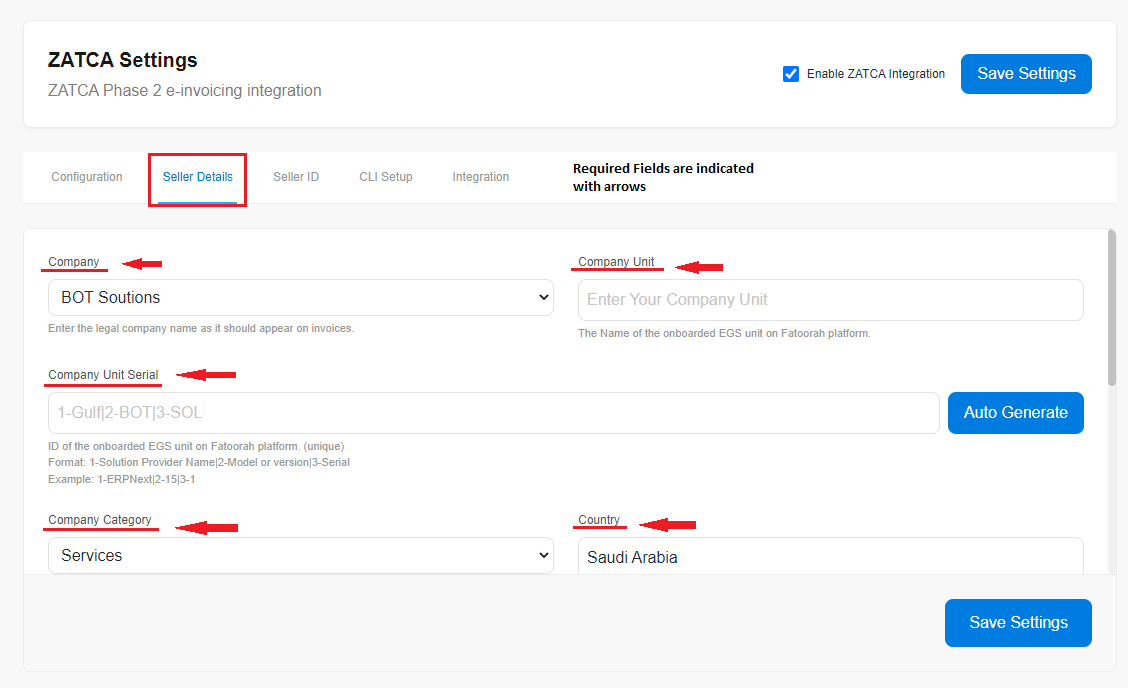

Seller Details Configuration

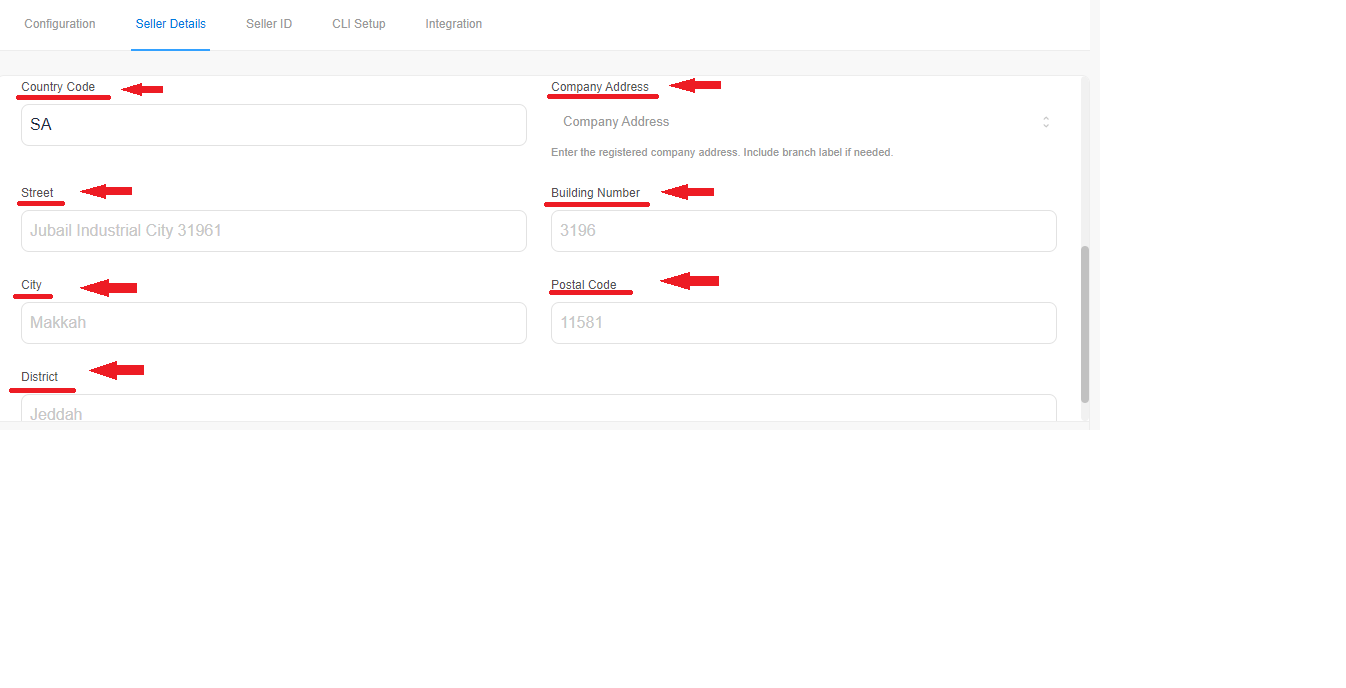

Navigate to the "Seller Details" tab in ZATCA Settings:

Required Fields

“The following required fields must be completed accurately to ensure successful ZATCA integration. Each field is explained below for clarity.”

- Company: Enter your legal company name as it should appear on invoices

- Company Unit: The name of the onboarded EGS (Electronic Generation System) unit on Fatoorah platform

- Company Unit Serial: Unique identifier for your EGS unit

- Format:

1-Solution Provider Name|2-Model or version|3-Serial - Example:

1-ERPNext|2-15|3-1 - Use the "Auto Generate" button to automatically generate this value

- Format:

- Company Category: Select from:

- Services

- Goods

- Both

- Country & Country Code:

- Country: Saudi Arabia

- Country Code: SA

- Company Address: Complete address details:

- Company Address (full address)

- Street

- Building Number

- City

- Postal Code

- District

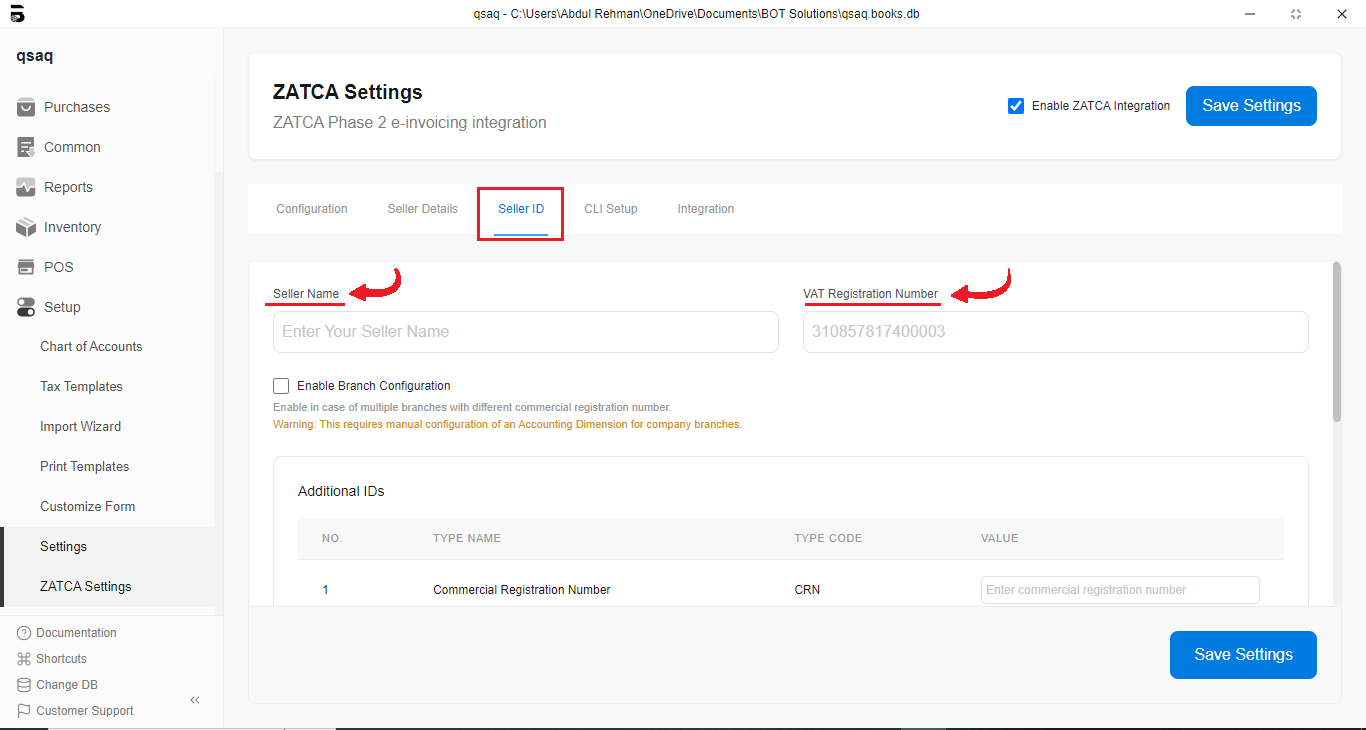

Seller ID Configuration

Required Fields

- Seller Name: Your registered seller name

- VAT Registration Number: Your 15-digit VAT registration number

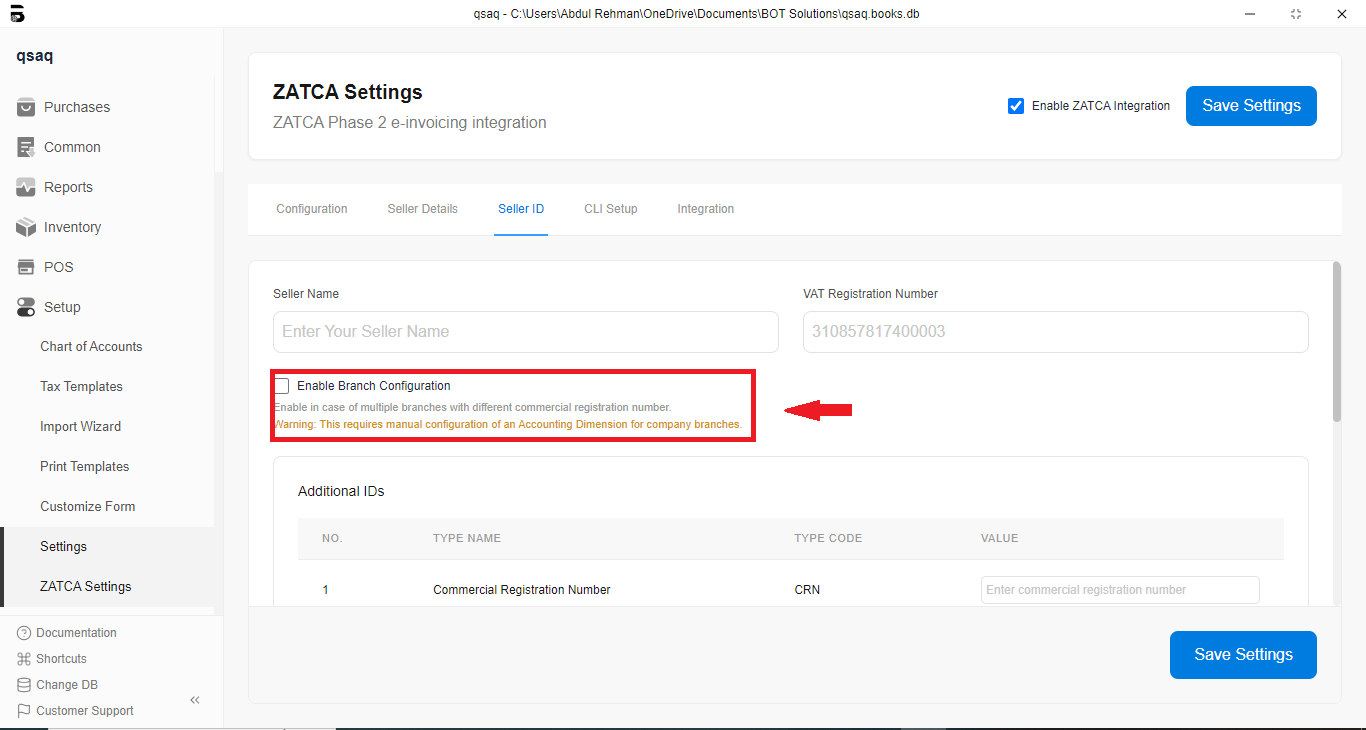

Branch Configuration (Optional)

If you have multiple branches with different commercial registration numbers:

- Enable "Enable Branch Configuration"

- Configure Accounting Dimensions for company branches

- Set up branch-specific VAT registration numbers

Warning: Branch configuration requires manual setup of Accounting Dimensions.

Additional IDs (Optional)

Add additional identification numbers if required:

- Commercial Registration Number (CRN)

- MOMRAH License

- MHRSD License

- 700 Number

- MISA License

- Other ID

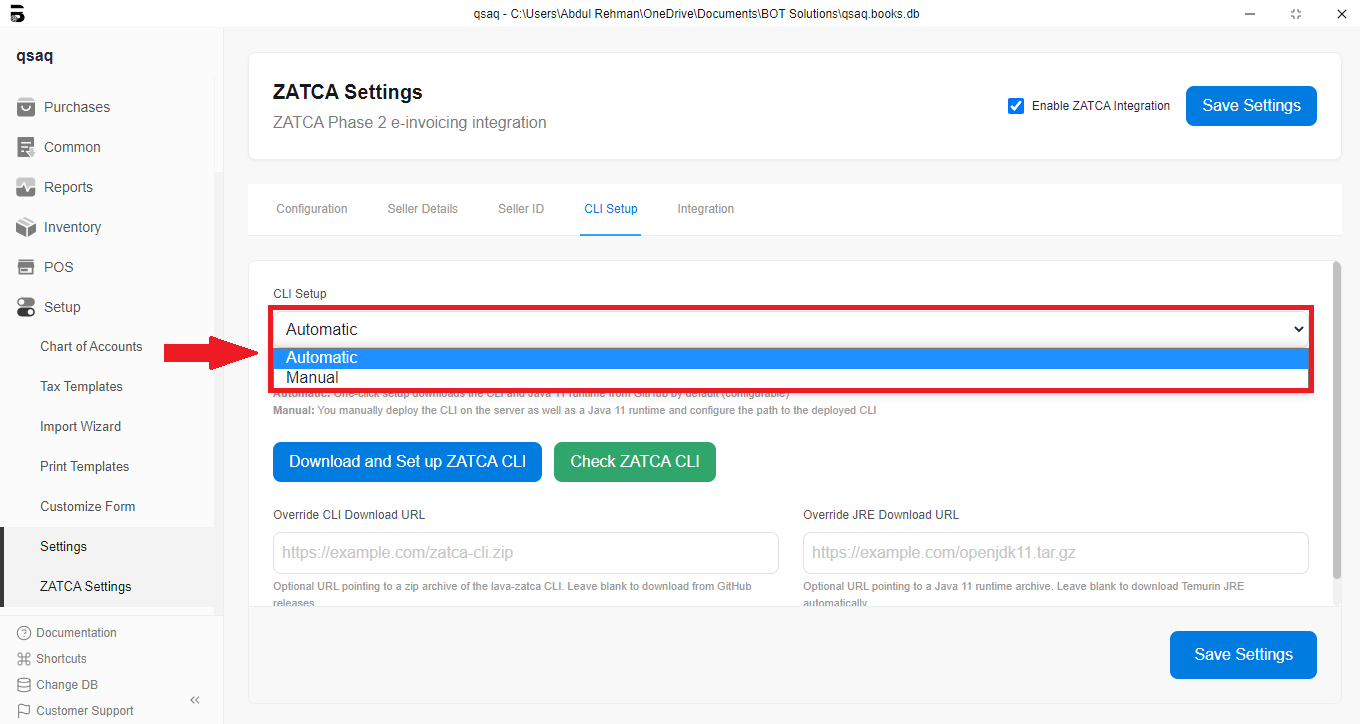

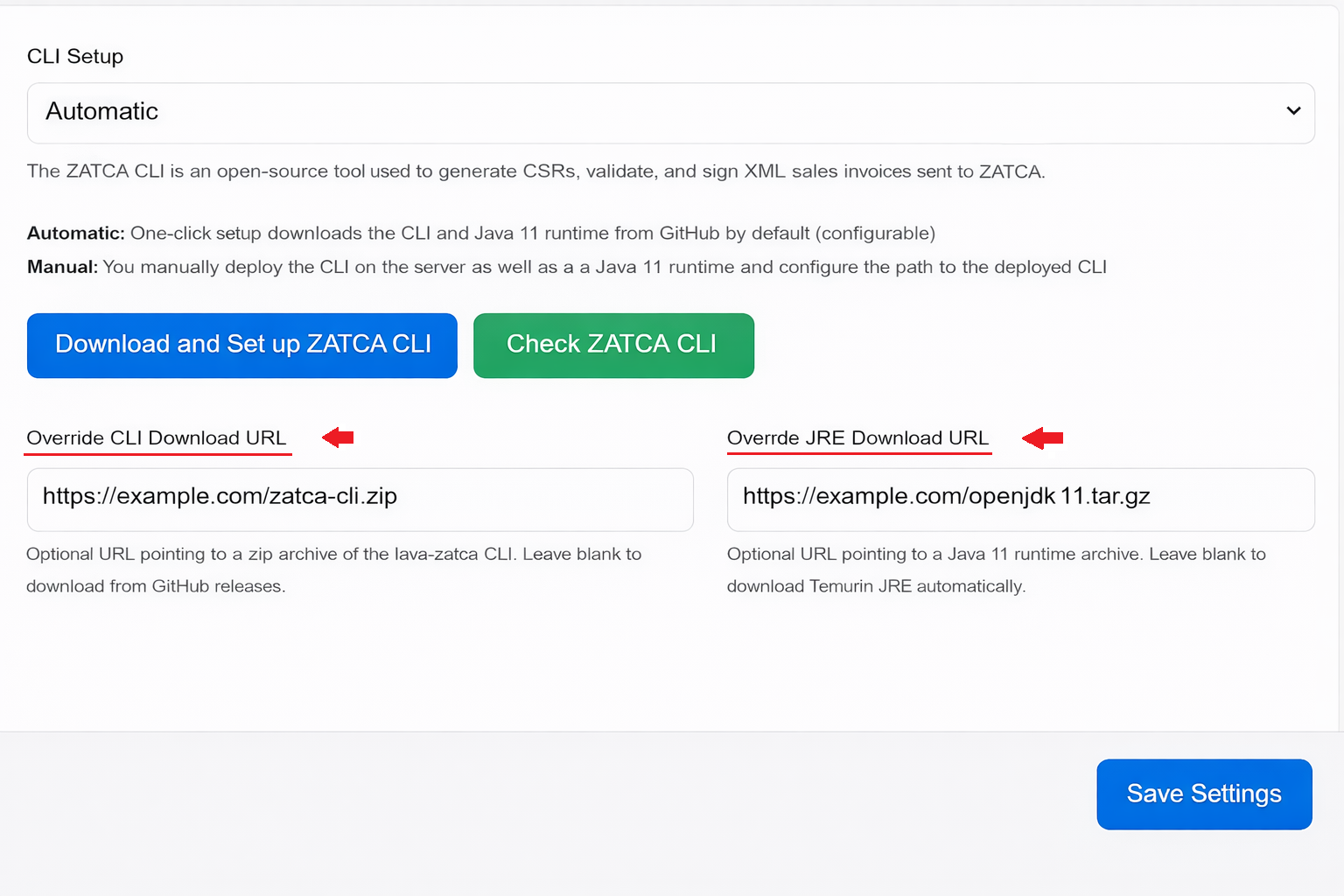

CLI Setup

The ZATCA CLI (Command Line Interface) is required for:

- Generating Certificate Signing Requests (CSR)

- Validating XML invoices

- Signing invoices digitally

Automatic Setup (Recommended)

- Select "CLI Setup" → "Automatic"

- The system will automatically:

- Download ZATCA CLI from GitHub

- Download Java 11 runtime (if needed)

- Configure paths automatically

Manual Setup

If you prefer manual setup:

- Select "CLI Setup" → "Manual"

- Download ZATCA CLI from: https://github.com/zatca/fatoora

- Install Java 11 or higher

- Configure paths:

- CLI Path: Full path to zatca-cli executable

- Example:

/home/user/zatca-cli/bin/zatca-cli(Linux/Mac) - Example:

C:\zatca-cli\bin\zatca-cli.bat(Windows)

- Example:

- Java Home: JAVA_HOME path (leave blank to use system default)

- CLI Path: Full path to zatca-cli executable

Override Download URLs (Advanced)

If you need to use custom download sources:

- Override CLI Download URL: Custom URL for CLI zip file

- Override JRE Download URL: Custom URL for Java runtime

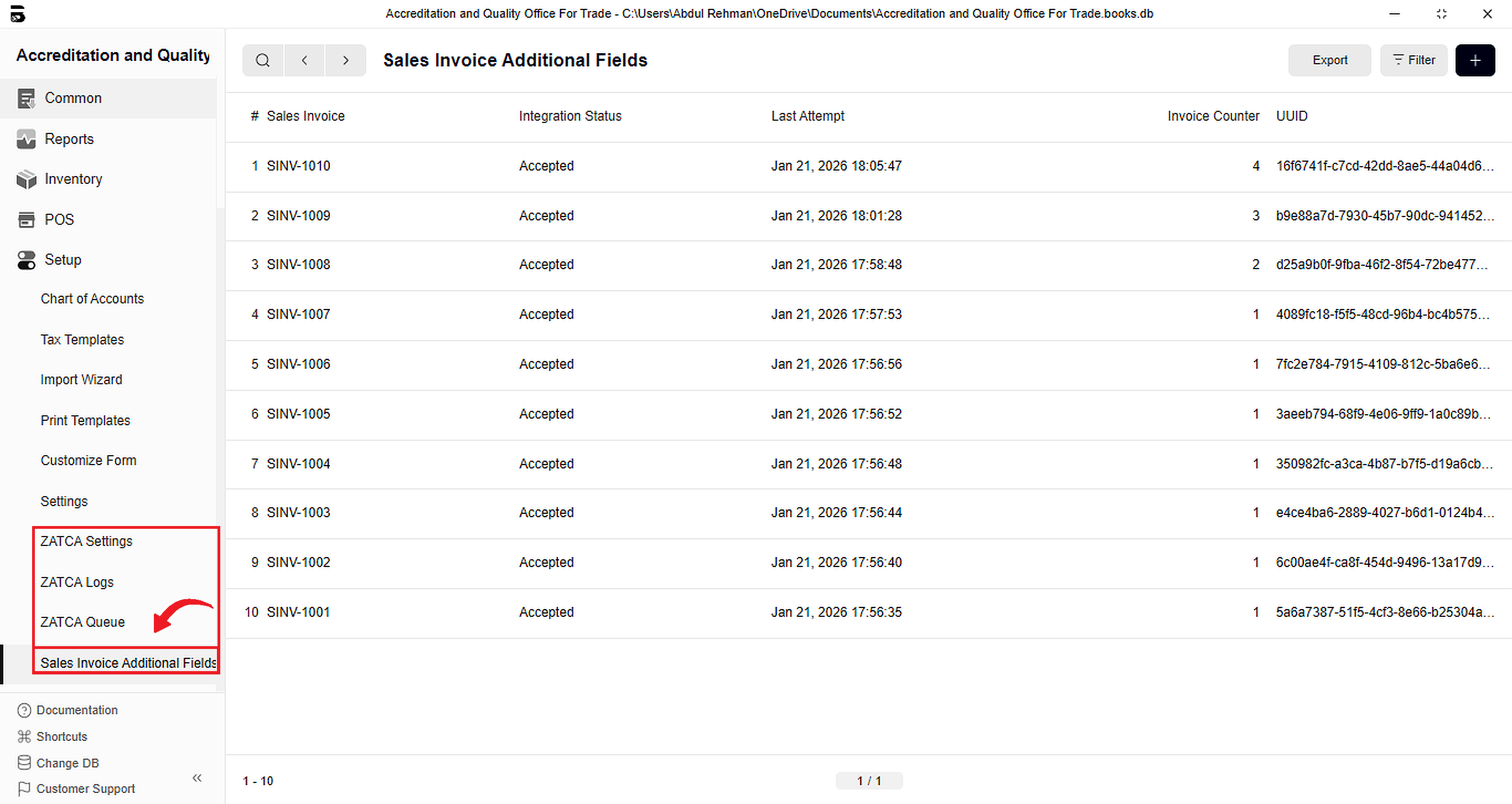

Sales Invoice Additional Fields

When ZATCA integration is enabled, each Sales Invoice automatically creates a Sales Invoice Additional Fields document containing ZATCA-specific metadata.

Accessing Additional Fields

- Open any Sales Invoice

- Navigate to the "ZATCA" tab or section

- View the Sales Invoice Additional Fields link

- Click to open the additional fields document

Key Fields in Additional Fields Document

Details Tab

- Sales Invoice: Link to the parent invoice

- Integration Status: Current status of ZATCA integration

Ready For Batch: Ready for submissionResend: Needs to be resentCorrected: Invoice was correctedAccepted: Successfully accepted by ZATCAAccepted with warnings: Accepted but has warningsRejected: Rejected by ZATCAClearance switched off: Clearance mode disabledDuplicate: Duplicate submission detected

- Last Attempt: Timestamp of last submission attempt

- Invoice Doctype: Type of invoice (Sales Invoice, POS Invoice, Payment Entry)

- Is Latest: Indicates if this is the latest version

- UUID: Unique identifier assigned by ZATCA

- Invoice Type Code: ZATCA invoice type code

- Invoice Type Transaction: Transaction type (B2B/B2C)

- Tax Currency: Currency code (typically SAR)

- Invoice Counter: Sequential counter for invoice hashing

- Invoice Hash: Cryptographic hash of the invoice

- Previous Invoice Hash: Hash of the previous invoice (for chaining)

Buyer Tab

- Buyer VAT Registration Number: Customer's VAT number (if B2B)

- Other Buyer IDs: Additional buyer identification numbers

- Buyer Address Details: Complete buyer address information

Invoice Tab

- Allowance Indicator: Indicates if allowances are applied

- Charge Indicator: Indicates if charges are applied

- Fatoora Invoice Discount Amount: Discount amount

- Sum of Charges: Total charges

- Invoice Line Charge Percentage: Percentage-based charges

- Invoice Line Charge Amount: Amount-based charges

- Prepayment VAT Category: Prepayment VAT details

XML Tab

- Invoice XML: Generated ZATCA XML (hidden by default)

- Download XML: Button to download the XML file

- QR Code: QR code image for the invoice

Integration Status Meanings

| Status | Description | Action Required |

|---|---|---|

| Ready For Batch | Invoice is ready for submission | None - will be processed automatically |

| Resend | Previous submission failed | Check errors and resubmit |

| Corrected | Invoice was corrected after submission | None - corrected version will be submitted |

| Accepted | Successfully accepted by ZATCA | None |

| Accepted with warnings | Accepted but has warnings | Review warnings |

| Rejected | Rejected by ZATCA | Fix errors and resubmit |

| Clearance switched off | Clearance mode is disabled | Enable clearance mode if needed |

| Duplicate | Duplicate submission detected | Check if invoice was already submitted |

Troubleshooting

Common Issues and Solutions

1. CLI Not Found or Not Working

Symptoms:

- Error: "CLI path is not configured"

- Error: "CLI verification failed"

Solutions:

- Verify CLI is installed: Click "Check CLI" in settings

- For Automatic setup: Ensure internet connection and try again

- For Manual setup: Verify CLI path is correct and executable

- Check Java installation: Ensure Java 11+ is installed and JAVA_HOME is set

2. Onboarding Failed

Symptoms:

- Error: "OTP verification failed"

- Error: "CSR generation failed"

Solutions:

- Verify all Seller Details are correctly filled

- Ensure OTP is entered correctly (check for typos)

- Verify OTP hasn't expired (OTPs are time-limited)

- Check internet connection

- Verify CSR format is correct

3. Invoice Submission Failed

Symptoms:

- Integration Status: "Rejected" or "Failed"

- Errors in Integration Log

Solutions:

- Check Errors field in Integration Log for specific issues

- Verify invoice has all required fields:

- Customer VAT number (for B2B)

- Complete address information

- Valid items with prices

- Tax calculations

- Check invoice counter and hash chain

- Verify ZATCA credentials are valid

- Check if invoice exceeds ZATCA limits

4. XML Validation Errors

Symptoms:

- Error: "XML validation failed"

- Error: "Invalid XML structure"

Solutions:

- Enable "Validate Generated XML" in settings for detailed errors

- Check invoice data completeness

- Verify all required ZATCA fields are present

- Review XML file directly (download from Additional Fields)

5. Hash Chain Broken

Symptoms:

- Error: "Previous invoice hash mismatch"

- Error: "Invoice counter invalid"

Solutions:

- Verify invoices are submitted in order

- Check if any invoices were deleted or modified

- Reset invoice counter if necessary (contact support)

- Ensure no manual invoice counter changes

6. Credentials Not Working

Symptoms:

- Error: "Authentication failed"

- Error: "Invalid credentials"

Solutions:

- Verify credentials are correctly entered

- Check if credentials have expired

- Ensure correct environment (Sandbox/Simulation/Production)

- Re-run onboarding if credentials are invalid

7. QR Code Not Generated

Symptoms:

- QR Code field is empty

- QR Code image not displayed

Solutions:

- Verify invoice was successfully submitted

- Check if UUID was received from ZATCA

- Ensure invoice status is "Accepted" or "Accepted with warnings"

- Try resubmitting the invoice

Debugging Tips

- Enable XML Validation: Turn on "Validate Generated XML" to catch issues early

- Check Integration Logs: Always check logs for detailed error messages

- Review XML Files: Download and review XML files for structure issues

- Test in Sandbox First: Always test in Sandbox before Production

- Monitor Queue Status: Check ZATCA Staged Invoice for processing status

Best Practices

Configuration Best Practices

- Start with Sandbox: Always begin testing in Sandbox environment

- Complete Seller Details: Ensure all seller information is accurate and complete

- Use Automatic CLI Setup: Prefer automatic setup unless you have specific requirements

- Keep Credentials Secure: Never share ZATCA credentials

- Regular Backups: Backup ZATCA settings and credentials

Invoice Creation Best Practices

- Complete Customer Information: Ensure customer addresses are complete for B2B invoices

- Verify VAT Numbers: Validate customer VAT registration numbers

- Accurate Tax Calculations: Ensure tax calculations are correct

- Proper Item Descriptions: Use clear, descriptive item names

- Correct Invoice Types: Use appropriate invoice types (Standard/Simplified)

Submission Best Practices

- Submit Immediately: Submit invoices as soon as they're created

- Monitor Status: Regularly check integration status

- Address Warnings: Don't ignore warnings - address them promptly

- Maintain Hash Chain: Never skip or delete invoices in the chain

- Regular Audits: Periodically review Integration Logs

Production Best Practices

- Complete Compliance Testing: Pass all compliance tests before going live

- Monitor First Invoices: Closely monitor first production invoices

- Set Up Alerts: Configure alerts for failed submissions

- Regular Testing: Periodically test in Sandbox to ensure system works

- Keep Documentation: Maintain records of all ZATCA operations

Security Best Practices

- Secure Credentials: Store credentials securely

- Limit Access: Restrict ZATCA Settings access to authorized personnel

- Regular Updates: Keep ZATCA CLI updated

- Monitor Logs: Regularly review logs for suspicious activity

- Backup Regularly: Regular backups of all ZATCA data

Additional Resources

ZATCA Official Resources

- Fatoorah Platform: https://fatoorah.gov.sa

- ZATCA CLI GitHub: https://github.com/zatca/fatoora

- ZATCA Documentation: https://zatca.gov.sa

Support

For technical support or questions:

- Customer Support: https://helpdesk.botsolutions.tech/login#login

- Documentation: https://docs.botsolutions.tech

Glossary

- B2B: Business-to-Business transaction

- B2C: Business-to-Consumer transaction

- CLI: Command Line Interface

- CSR: Certificate Signing Request

- EGS: Electronic Generation System

- OTP: One-Time Password

- QR Code: Quick Response Code (for invoice verification)

- UUID: Universally Unique Identifier

- VAT: Value Added Tax

- XML: eXtensible Markup Language

- ZATCA: Zakat, Tax and Customs Authority (Saudi Arabia)